november child tax credit check

The deadline for the next payment was November 1. The actual time the check arrives.

Child Tax Credit Payment Schedule For 2021 Kiplinger

The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17.

. IR-2021-211 October 29 2021 On Monday November 1 the Internal Revenue Service will launch a new feature allowing any family receiving monthly Child Tax Credit. To be eligible for advance payments of the Child Tax Credit you and your spouse if married filing jointly must have. As the final month of 2021 slowly approaches so do the last stimulus checks to families as.

Eligible families who did not opt-out of the monthly payments are receiving 300 monthly. The first of the Government of Canadas new financial support measures will take effect this Friday November 4 2022 with the additional one-time goods and services tax credit. Mark These Dates on Your Calendar Now Social Security Schedule.

The last opt-out deadline for the last future payment of the current version of the advance Child Tax Credit is November 29. 15 2022 according to the District of. This enhanced child tax credit is part of the 19 trillion American Rescue Plan ARP the same package that approved stimulus checks of up to 1400.

Up to 300 dollars. Filed a 2019 or 2020 tax return and claimed the Child Tax Credit on the. When November 2022 Benefits Will Be Sent.

Instead of calling it may be. The last opt-out deadline for the last future payment of the current version of the advance Child Tax Credit is November 29. The IRS has not announced a separate phone number for child tax credit questions but the main number for tax-related questions is 800-829-1040.

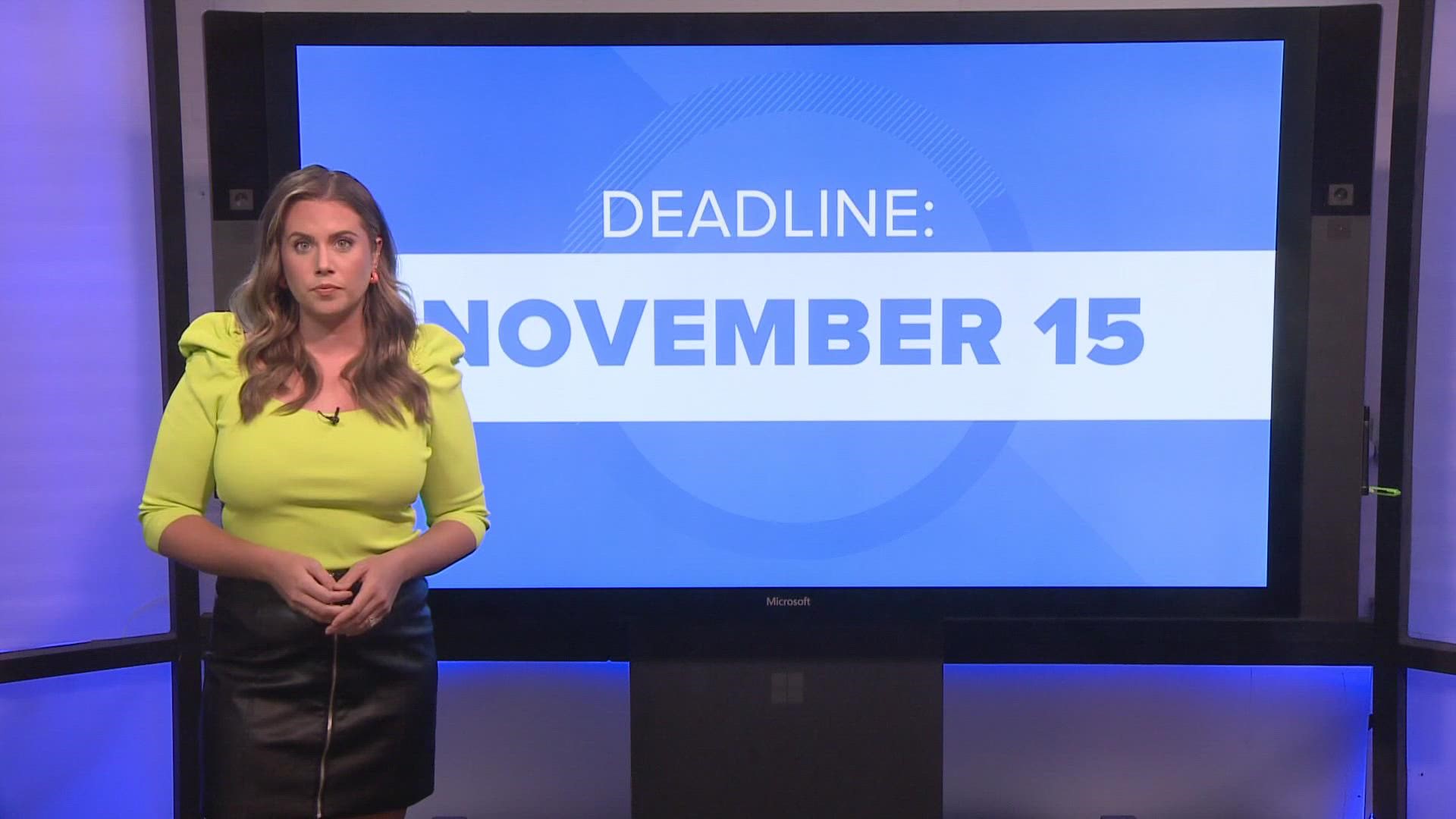

The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17. Well tell you when this payment will arrive and how to unenroll. Even if you have no earned income and have not yet filed a 2021 tax return you can still get a credit of up to 3600 if you claim it by Nov.

Only one child tax credit payment is left this year. First the credit increases from 2000 for children under age 17 in 2020 to 3600 for each child under 6 years and 3000 for each child age 6 up to age 17 for 2021. This years expanded Child Tax Credit allotted 3600 per child age five and under in all eligible families and 3000 per child ages six to 17.

This is the second to last payment of the. CBS Baltimore --The Internal Revenue Service IRS sent out the fifth round advance Child Tax Credit payments on November 15. Eligible families who did not opt-out of the monthly payments are receiving 300 monthly.

The deadline for the next payment was November 1. Eligible parents should start receiving the latest child tax payment on November 15. Child poverty reached the lowest ever recorded according to the calculations through the Supplemental Poverty Measure which included both non-cash and cash benefits.

MILLIONS of Americans have the chance to cash in on two more stimulus checks in the form of the child tax credit that are set to hit bank accounts this year. The enhanced child tax credit which was created as part. Even if you have no earned income and.

The payments were split up into six. The stimulus check part of President Joe Bidens child tax credit plan will see those who meet the final November 15 deadline potentially receive up to 1800 per child come. The Earned Income Tax Credit is calculated by the amount of earned income you received in 2021 your filing status and the number of qualifying children claimed as dependents on your.

With the November payments still on their way to some families this is an updated list of the 2021 Child Tax Credit advance payments schedule. The fifth installment of the advance portion of the Child Tax Credit CTC payment is set to hit bank accounts today November 15. Those who miss the deadline can still claim the credit of up to 3600 per child if they file a 2021 tax return next year.

![]()

Opinion Fed Data Shows Families Fared Better When Child Tax Credit Came Monthly Maine Beacon

Child Tax Credit Advance Payments Unexpected Surprise

Child Tax Credit Delayed How To Track Your November Payment Marca

Child Tax Credit November Payments Arriving In Parents Bank Accounts Cbs Baltimore

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

Monthly Payments For Families With Kids The 2021 Child Tax Credit United For Brownsville

Gov Urges Eligible Ct Families To Apply For Child Tax Credit Before Nov 15 Deadline Nbc Connecticut

Eligible County Residents Have Until November 15 To Claim Stimulus Payments And Other Expanded 2021 Tax Credits

Stimulus Check Update These Families Could Get Up To 1 800 Per Child In December Whp

Stimulus Checks Child Tax Credits Millions With Money Unclaimed 11alive Com

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

Child Tax Credit Updates To Know For November Nasdaq

Child Tax Credit In The Mail Ct News Junkie

Stimulus Update Some Child Tax Credit Payments May Be Lower In October November And December Al Com

Stimulus Update November Child Tax Credit Maine S Agi Checks Golden State Checks For Social Security Recipients

When Is My November Child Tax Credit Coming Irs Payments Abc10 Com

Future Child Tax Credit Payments Could Come With Work Requirements

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities